Latest thinking on inflation

Inflation is the economic topic of the hour. Always an exciting topic, as a recent video from the Bank of Jamaica shared by Nick Gray demonstrates.

We've discussed inflation in issues past summarized here: Inflation? Deflation? Nobody knows for sure. I've linked to Ray Dalio with his 'The changing value of money' and Paul Tudor Jones' discussion of 'the great monetary inflation''. Later, we followed that up with Prof Olivier Blanchard's piece on what you'd have to believe for there to be high inflation, which is also a good read.

At least two worldviews:

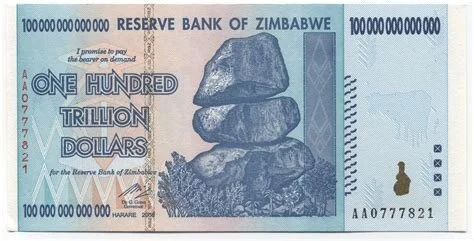

First, is the pragmatists and macro investors' view. They look at the ballooning US Debt to GDP Ratio and devise how the US government might repay. Quickly, they realize that the government won't. And, as such, the US will have to 'monetize' the debt by inflating it away. Ideally, this would happen slowly. So, even though inflation may be low today or tomorrow, it exists. And it will almost certainly have to accelerate. The question is: when and at what rate?

Second, is the more academic view focused primarily on the present and based on measurement of the state of the labor market, inflation expectations, and shocks to commodity and food prices. This view may show that deflation is the bigger concern as commodity prices like oil are still low and consumers may buy less and save more.

Federal Reserve Policy

The US Federal Reserve held its annual meeting this week, and Chairman Jerome Powell announced that the Fed would target ~2% inflation and would be reticent to increase interest rates anytime soon. So, that's the stated policy. How it will play out in practice in an uncertain future is anyone's guess.

Why target inflation? There is worry that the U.S. could be entering a low-growth, low-inflation period.

In inflationary environments, borrowers will be rewarded at the expense of lenders and depositors. Investors and entrepreneurs will be more able to adapt to rising prices, while those who are tied to fixed cash income will see their buying power erode.

Bloomberg opinion writers have had many thoughts leading up to the conference. I've enjoyed the following takes: Bitcoin Bulls: Winklevoss Capital predicts $500K Bitcoin (not that they have an interest or anything) and cash is the most dangerous asset in the portfolio by Mike Lipper.

Questions for the curious:

How are we measuring inflation? What does that measurement mean, practically?

What is the timeframe for inflation? If you believe equities are in an asset-bubble, you may believe it's already underway.

What is the best way to position your investment portfolio? I'll give a stab at the summarizing the advice out there:

Gold

A traditional commodity one might buy to hedge against inflation. Gold has seen a massive run up in price in the last couple months, suffered a correction a week or so ago, and is back rising.

The Yield Curve

The difference between the short term and long-term treasury rises as investors believe that real returns in the long-term will be eroded by inflation.

Nasdaq 100

I know it's hard to see but you get the point. That's the 100 largest tech equities and their growth over time. You get the point on all-time high equity prices and people willing to pay high multiples for growth stocks.

Bitcoin

See the Winklevoss Capital case. Here's what they say:

Bitcoin has already made significant ground on gold — going from whitepaper to over $200 billion in market capitalization in under a decade. Today, the market capitalization of above ground gold is conservatively $9 trillion. If we are right about using a gold framework to value bitcoin, and bitcoin continues on this path, then the bull case scenario for bitcoin is that it is undervalued by a multiple of 45. Said differently, the price of bitcoin could appreciate 45x from where it is today, which means we could see a price of $500,000 U.S. dollars per bitcoin.

Real Estate

Tough to say. A lot depends on the asset these days given the upheaval in cities, how/where people work, the ability for people to gather in place. But traditionally, the value of the property rises with inflation and the amount tenants pay in rent can increase over time so RE investment can keep pace with the general rise in prices across the economy